.png)

You can boast of your good budgeting skills; however, unplanned emergencies may come forth anyway and require quick financial solutions. The lack of cash to address these expenses might be concerning. If you don't want to rely on friends or family, you can seek a loan. Though traditional loans can help you fulfill your needs, the lengthy procedures, tedious paperwork, and delayed money transfers make them an inappropriate alternative when you need cash quickly. In contrast, direct deposit loans in minutes might assist you in acquiring the extra money you need quickly. So, what exactly are direct deposit loans, and how do take avail of them? Continue reading to find out the answers to these questions.

What Are Direct Deposit Loans in Minutes?

Direct deposit loans are quick borrowings that may be available online within minutes. They are known as direct deposit loans, as the borrowed money is directly deposited into the borrower's bank account. The speed of getting these loans is mainly due to the soft credit checks that the lenders carry out. No time-requiring hard pulls, no strict requirements!

Direct deposit loans are offered in amounts ranging from $100 to $2500. However, keep in mind that the amount may differ based on several factors.

State requirements: Rules and regulations regarding internet lending vary from state to state. In some states (Arkansas, Arizona, and Georgia), online lending is prohibited; in others, like California and Minnesota, there are limits on the amount borrowed; and in the third (Maine, Wisconsin), there are no restrictions on your borrowing options. Check your state's requirements before taking out a loan.

Financial status: The soft checks don't mean their absence at all, as the lender should ensure the borrowing is affordable for you, and you can return the money together with interest on the specified day. So, if you apply for $2000 and get approved only for $1000, don't be surprised.

The lender's disposal: Even if your state permits, the lender may not be willing to provide you with the requested amount. And vice versa, the lenders may offer you even more than you request. However, we don't recommend taking more than you need to not burden with debts.

Why Get Direct Deposit Loans in Minutes?

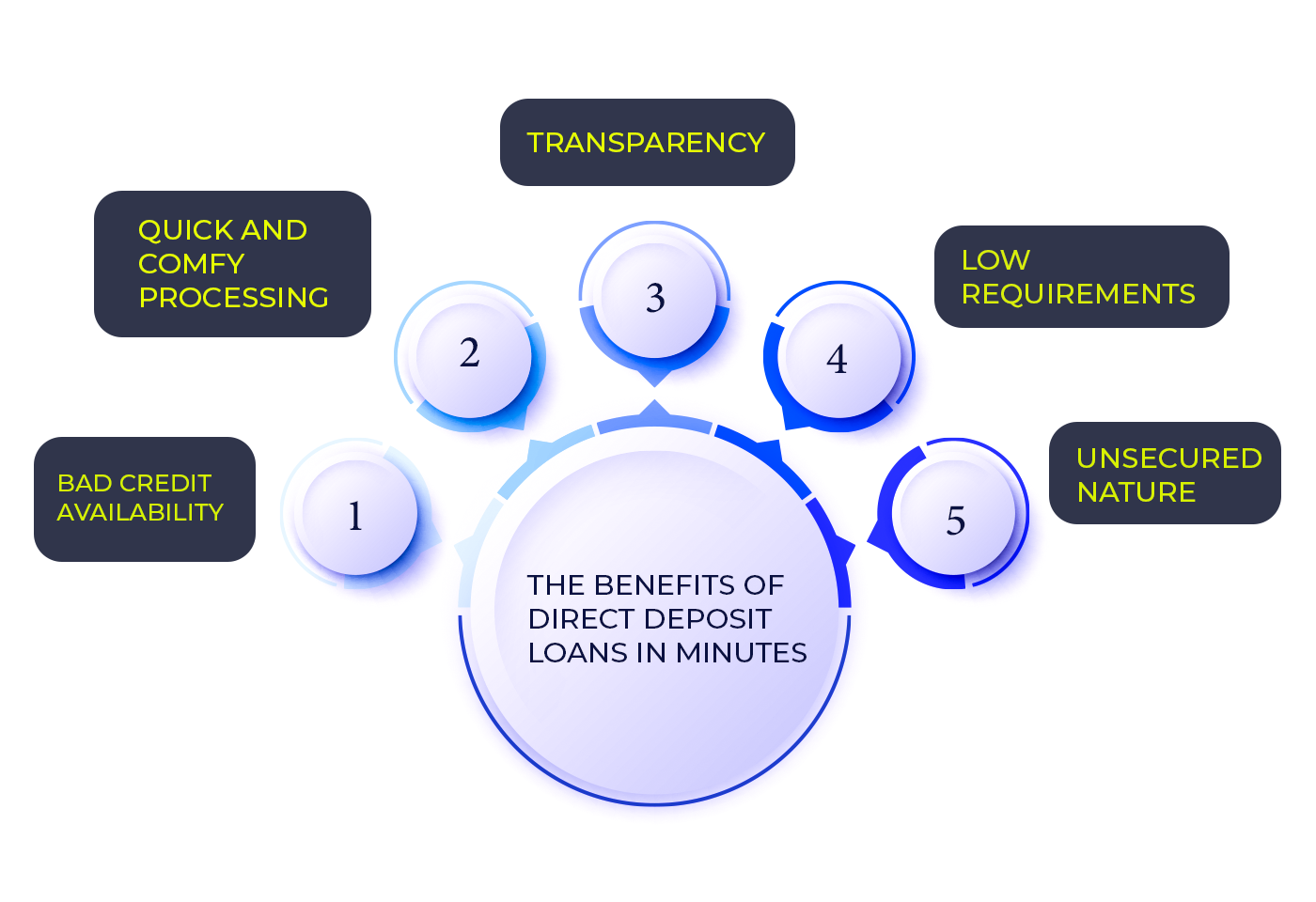

These borrowing types offer many benefits to people in need of quick cash advances. Here is why you may want to consider direct deposit loans:

They Are Available to Bad Credit Score Holders

The bad credit availability makes these loans very appealing to people having some failures in their credit history. However, traditional lenders regard these borrowers as risky and restrict borrowing opportunities. Fortunately, online lenders don't make their loan decision based on previous credit history; they look at their current financial situation instead.

No Cosigner, No Collateral Is Required

Another appealing factor for getting direct deposit loans is that they are not collateralized. So, you don't need to secure your small amount against a pricey property. The good thing about unsecured borrowings is eliminating the risk of losing the secured assets in case of late or non-payment. Besides, you are not required to have a cosigner to get loan approval. Bringing a cosigner is not an easy task, as you put your relations at stake.

Getting These Loans Is Quick and Comfy

As compared to conventional lending institutions, online lending companies do not typically require lengthy procedures like carrying a bunch of documents and driving to the lender's offices to get the approval and get the cash. You fill out a loan application with direct deposit loans and get the money deposited into your checking account. No hassles with paperwork, no long queues in the banks!

The Direct Deposit Loans Are Transparent

Before lending you money, the online lender sends you a loan agreement that includes detailed information about the loan terms, fees, and APRs. The borrower should read the contract up to the end to make sure every point is clear. Receiving an agreement doesn't mean you should necessarily get the loan. If you find some point unsatisfactory, you may cancel it.

Online Lenders Perform Soft Pulls

Soft credit checks make these borrowing options available for all types of credit holders and won't affect their credit score. In addition, the online lenders don't request inquiries from credit bureaus, so borrowing these loans won't be seen in your credit portfolio as long as you pay the borrowed sum as required. However, be aware that credit failures will be reported to credit agencies, down your credit score.

What to Consider When Getting Direct Deposit Advances

Though these borrowings may turn out to be pretty handy solutions for people in need, the borrowers should consider several factors when applying for these credit types.

High-Interest rates: Direct deposit loans might be more expensive than traditional borrowings. As with any unsecured online loan, these loans are on the risky side, and this risk factor is interpreted into the high-interest rates.

These borrowings are for minor financial problems: These credit sorts are designed to tide you over in between your paycheck. From small medical procedures to minor damages to your car or home may require immediate cash. That’s when these loans may be helpful. Otherwise, for the big-expense and long-term issues, you should consider other options.

Conclusion

Thanks to advanced technologies, direct deposit loans in minutes, can provide you with the assistance you are looking for. Thus, anytime you need a short-term financial boost to help you through until your next paycheck arrives, consider the loans with a direct deposit. Keep in mind that speed and convenience come at a cost, so you'll have to spend a little extra to take advantage of these loans. However, if you believe you can afford to repay these loans plus interest on your next salary, a direct deposit loan is the way to go!