In today's world, money is a powerful force, and we all rely on this in our daily lives. Finding a mature person who does not have a bank account or does not intend to use credit cards is difficult. However, we may find ourselves in a situation where we have a cash shortage.

What do Americans do when they run away from a financial situation? Many people borrow from friends, while others prefer to sell goods they don't need. However, you may ask what a person can do if none of these options are available. Texas payday advances might be a safe and legal way to solve your problem in these situations.

You should not be afraid to take out cash advances from reputable credit service providers. You can't fathom how many folks used cash financing in Texas with no credit check to address their difficulties.

The borrowing length might range from two to four weeks in many cases. As a result, such financial institutions avoid dealing with large sums of money. However, borrowers are obliged to fully return the debt on its due date.

So, if you're short on cash and don't know where to turn, consider online payday loans in Texas right now. If you don't want to run into any financial difficulties, this is a sensible option. Even if you have no prior expertise with financial concerns, go ahead to look through informative articles available on our website.

No Credit Check Loans in Spring, TX. How Do They Work?

Before you consider Texas payday loans online, keep one thing in mind. This form of financing may be available right away online from the comfort of your home. This type of financial solution is built on providing consumers with private, direct lender loans.

Keep in mind that the amount of short-term funding is not as great as that of long-term installment credit. Lenders often provide somewhere between $100 and $2,500. The variables of payday loans Texas rules define these sorts of constraints. Americans usually opt for this funding option when they are in dire straits. Typically, their salary permits them to get cash to repay them on a short-term basis. This is why such tools are frequently referred to as 'quick.'

Cash advances usually feature excessive interest rates going sky-high up to three-digit numbers. This amount may appear to be significant. However, keep in mind that you aren't dealing with massive, long-term installments. Quick loans online in TX Online, work uniquely. The cost has gone up, but the debt length has shrunk. For example, if you take out $400, you could expect to pay roughly $440.

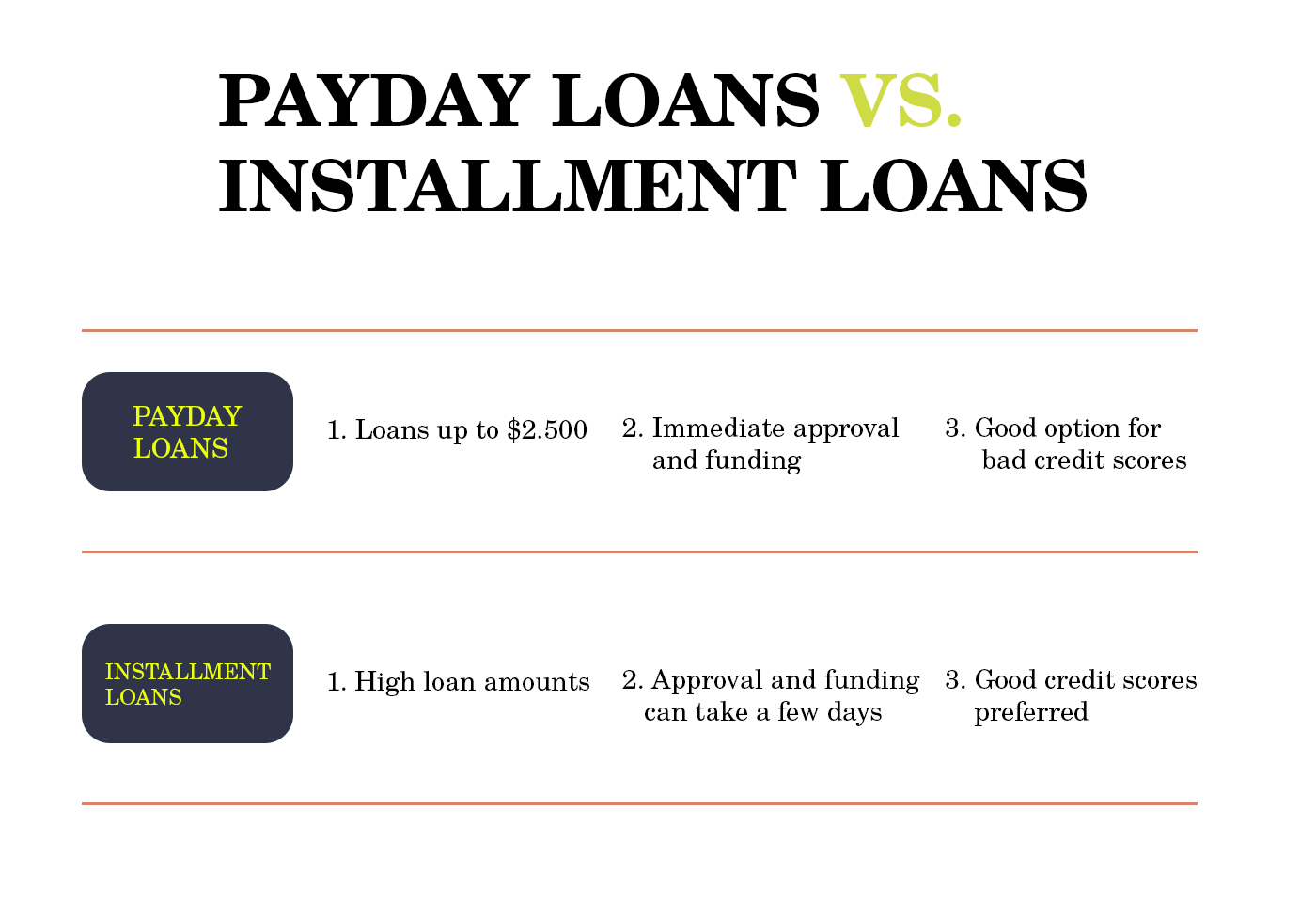

Payday VS Installment Loans

It's critical to understand the difference between payday and installment financing. Both are for a small amount of money. While cash advances must be paid back in full on a certain date (generally the borrower's next payday), installment loans can be repaid in regular monthly payments over a longer period. Furthermore, payday financing is for a shorter time, whereas installment financing might last for several years. You may settle a payday debt loan whenever you are ready; meanwhile, installment funding may incur additional fees, referred to as early repayment fees.

Advantages of Getting Online Payday Loans in Texas

Quick and Convenient Forms: The primary issue with most traditional lenders is the time you spend while securing financing. When time is of the essence, passing through a lengthy and difficult-to-understand lending procedure is the last thing you want to do. Instead, you may secure quick advances in as little as two minutes using our simple forms.

No Prepayment Penalties: A payday loan is an excellent choice for borrowers who wish to pay off their debts as fast as possible. You won't pay early repayment charges if you decide to settle a debt earlier than agreed on in a credit agreement. However, prepayment penalties frequently come with additional costs, so it's best to avoid them if at all possible.

Versatility: One of the most appealing aspects of payday lending is that cash may be used for almost any purpose. These loans can assist you whether you want funds to repair your vehicle or just wish to purchase new clothing. You aren't restricted from utilizing the funds just in an emergency. This is an excellent approach to earning some additional income when you need it without explaining why. As a result, one of the benefits of taking out an online payday loan is that there are no limitations. You may use the money toward anything you desire, whether it's an unexpected need or a long-awaited purchase.

No credit check: Cash loans are ideal for those with poor or no credit. You won't have to be concerned about your credit score preventing you from getting a loan. You may acquire a payday loan regardless of your credit score as long as you meet the eligibility conditions. Unlike traditional institutions, payday lenders qualify your profile other than based on your credit rating; that's why getting financing with bad credit is absolutely possible.

How to Qualify for Online Payday Loans in Texas?

Securing a cash loan in Texas is a straightforward process with LendersAdvance.com, but you must be aware of some eligibility criteria:

- You must be 18 years old or older. In the United States, lending money to someone under 18 is unlawful. So, if you're over the legal age, you match the first criteria.

- You must be a legal Texas resident. To acquire a payday tool in Texas, you must first prove that you are a legal resident by submitting your contact information.

- Your negative credit isn't an issue, but you'll still need a steady source of income and a monthly income of at least $1,000. This way, the lender can be confident you'll be able to pay back the loan.

- You'll need a phone number and an active email address to get fast approval. The lender won't be able to get in touch with you unless you supply this information.

- Finally, you must not be a bankrupt debtor.

You may be requested to fill in some personal details in a credit request form, such as your social security number, name, address, and identification number. After you supply all the necessary information, the lender may contact you to verify the agreement terms and conditions. A little cash advance may be a valuable and convenient asset when dealing with emergency problems. However, keep in mind that these financing tools will not be able to solve major financial problems. Moreover, taking out too many debts at once is not a good idea, as you risk jeopardizing your financial security.