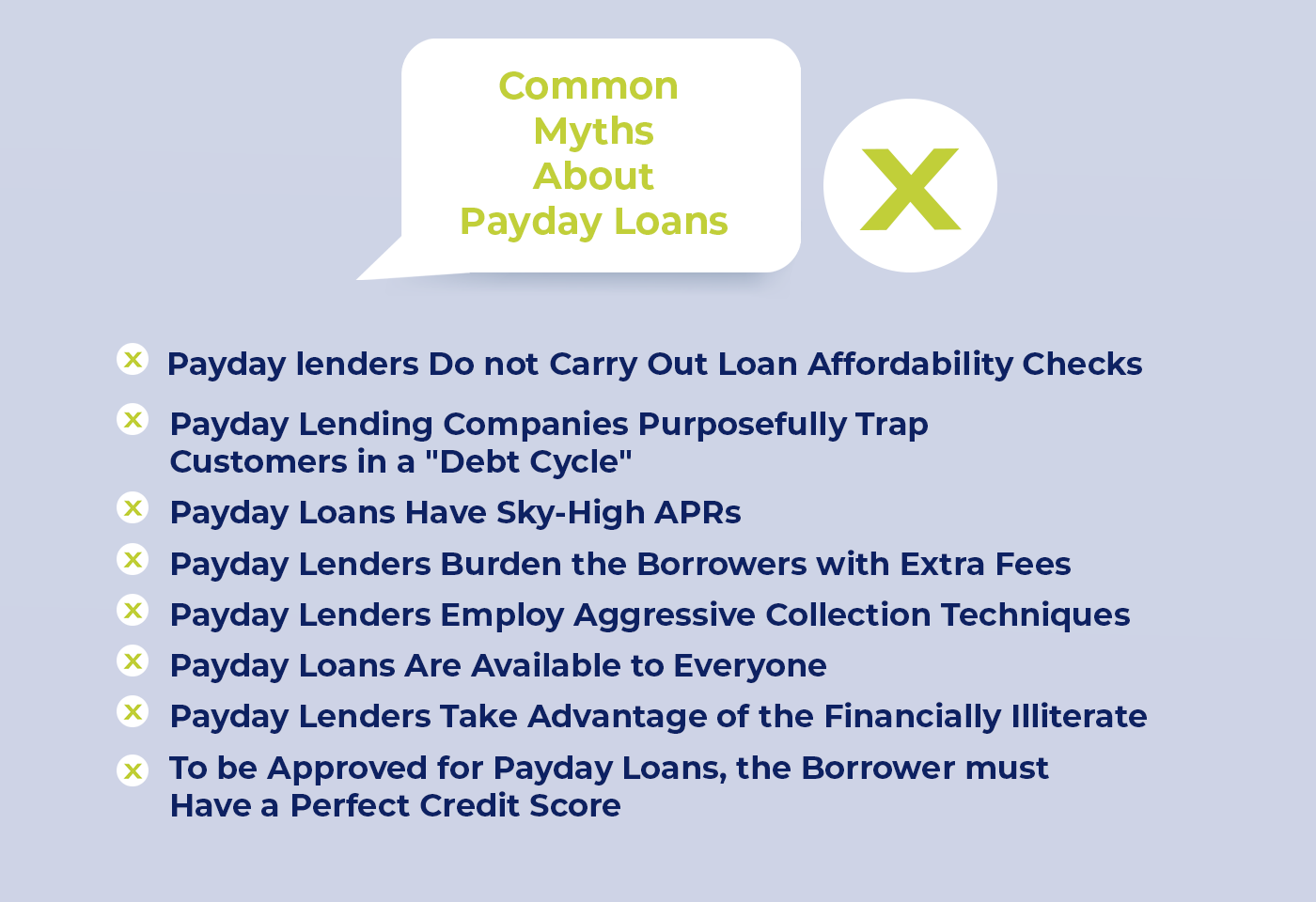

Payday loans have developed a reputation for preying on vulnerable people. It's sad because these short-term small borrowings may be convenient in certain instances. Numerous individuals have profited from using payday loans in a financial crisis, but with the online scams that the Internet is full of, many payday loan fallacies have been spotted that earned a bad reputation for these loans. However, the reality about small-dollar loans differs substantially from the myths spread by industry opponents. We have prepared a list of the common myths to help you discern fact and fiction.

Payday lenders Do not Carry Out Loan Affordability Checks

One of the most popular misconceptions regarding payday lenders is that they issue cash without considering the customers' capacity to repay the loan. Although payday lenders do not do hard credit checks, this does not mean that they will grant money regardless of the circumstances. However, before approving your loan request, lenders consider your present income situation. As a result, be aware that respectable payday lending organizations will not provide a loan that a client cannot afford to repay.

Payday Lending Companies Purposefully Trap Customers in a "Debt Cycle"

The borrowers adhere to online lending when they need quick financial assistance. The lending companies provide loans that match but don't exceed the borrowers' needs.

Lenders are eager to work with creditworthy borrowers, but life is unpredictable. If a borrower has difficulty making on-time payments, lenders work with them to discover solutions to their unique circumstances while repaying the loan. If permitted by state law, the lenders may offer an Extended Payment Plan that provides the borrowers with a longer repayment plan with or without extra cost. Payday loans are meant to help people get out of a financial bind, so they are provided only with the consideration of the payability of the borrowers.

Payday Loans Have Sky-High APRs

The opponents of payday loans often accuse them of having high APRs than banks and credit unions, overlooking that these loans are lent only for short repayment terms that range from two to four weeks. So, it is unfair to assess the loan costs by the APRs (Annual Percentage Rates).

We admit that the rates may be greater than conventional banks as payday lenders work with risky borrowers and the non-return factor always exists.

Payday Lenders Burden the Borrowers with Extra Fees

Payday lenders give all information to borrowers, including interest rates and costs, in the loan agreement. Borrowers can negotiate and understand all prices with lenders ahead of time. Despite their high price, these loans are entirely transparent. You will never be harassed by unexpected expenses when your repayment date arrives.

Payday Lenders Employ Aggressive Collection Techniques

One fallacy surrounding payday loans is that lenders utilize harsh collection techniques. Payday lenders use legal means to collect past-due payments. They connect with debtors who have difficulty with delayed payments and respectfully discuss alternatives to settle the loan. Date extensions are always negotiable with lenders.

Payday Loans Are Available to Everyone

Even though payday loans are relatively easy to obtain, lenders have some requirements that consumers must satisfy. Thus, to qualify for a loan, the ideal candidate should be a US citizen who has attained the age of 18 and has demonstrated income that is not a necessary wage but might be anything from a side hustle to a pension or other social payments. Furthermore, debtors must submit accurate personal data (complete name, phone number, and address) to pass the identification process. Finally, having an active bank account is required for approval since lenders send the needed cash online and withdraw the funds when the due date arrives.

The absence to address one of these requirements may result in the loan request denial.

Payday Lenders Take Advantage of the Financially Illiterate

People who make such claims fail to see that a financial emergency has nothing to do with literacy. Even strong budgeters might sometimes run into financial challenges, and literacy can help them get through the tough times with payday loans. However, knowledgeable people will undoubtedly perform the necessary calculations and take advantage of these short-term loans to alleviate stress and financial strain.

To be Approved for Payday Loans, the Borrower must Have a Perfect Credit Score

Payday lenders cater to a broad spectrum of demographics. Because they do not target or market to a specific demographic, their services are meant to be flexible to all conditions. In contrast to banks and credit unions, payday lenders provide loans based on income and credit score. Thus, with mild credit checks, internet lenders make these online borrowings readily available to the unbanked.

Payday Loans: Reality

After debunking all of these payday lending myths, you'll be able to shed the bad reputation associated with these small loans. These loans are a bit pricey, but they are a legit way to get through complex financial problems that generate a lot of worries. Payday financing might be a good option when you need immediate financial assistance if you pay it back appropriately and responsibly. However, late payments will further cost and lock you in a debt cycle like any other traditional loan. So, whether you take avail of payday loans or not is entirely up to your informed financial judgments and calculations.