An installment loan is quick financing that gives the borrower a large sum of money upfront and requires paying it off in partial payments over a certain period. As a result, an installment loan is known as a term debt. These funding tools are also good as a short-term financing option. However, on the other hand, most installment tools are for larger amounts payable over months or years. Generally, the greater the debt, the longer the repayment period.

Types of Installment Loans Online

These are among the most prevalent types of quick financing, including mortgages, car, personal, and student financing.

Mortgages

A mortgage is a type of installment loan used to finance the purchase of a home. Mortgages are generally payable in monthly payments over 15 to 30 years. Some mortgages have fixed interest rates that do not fluctuate over time. This also implies that the principal amount and interest contributions will remain unchanged.

Auto Financing

Auto loans are normally payable in equated monthly payments over one to ten years; however, not all lenders offer these terms. Typically, longer-term financing features lower monthly payments but higher APRs. This means that, even though you pay smaller monthly amounts, you may wind up paying more in interest and finance charges in the end.

Personal Loans

Personal advances are a sort of installment tool that may be used for several reasons, such as debt consolidation or paying off unexpected costs such as medical bills or car breakdowns. However, interest rates on personal advances are often higher because they usually don't need collateral, such as your car or home debt.

What to Consider When Choosing a Loan?

Compare APRs: The credit cost is sometimes stated as an annual percentage rate (APR), which typically includes interest rates and credit-related fees. Look for the lowest possible APR – the best user-friendly personal advances have rates of less than 36%.

Understand costs: Some lenders levy a credit origination cost of 1% to 10% of the original debt amount, as well as late fees. Don't sign a credit agreement until the lender has revealed all costs.

Examine the monthly payments: Your monthly contributions will be calculated based on the debt payback terms. Indeed, the longer your debt repayment period, the more interest you'll pay. So look for payback terms that are short enough to prevent spending too much in interest while yet being reasonable.

Pre-qualify: Pre-qualifying for a bad credit installment loan is a quick and easy way to determine whether or not your credit request will be approved. First, you'll need to fill out some personal information, such as name, email, phone number, and banking information. The lender's credit check will not impact your credit score since it's not a hard credit inquiry. Following that, you'll be able to discover what rates, terms, and amounts you could be eligible for.

Advantages of Installment Loans

These loans offer predictable repayment terms. If you opt for a fixed interest debt, neither the principal amount nor the interest rate will change over the payback period. Predictable debt contributions are easier to budget, reducing the risk of skipping payments due to unforeseen changes in your debt.

If you're looking for an installment credit, be sure the monthly payments won't break your budget. If they do, you may find it challenging to make your full payment once a financial emergency arises.

Installment advances also provide you the peace of mind that your debt will be paid off by a specific date. After completing the number of payments outlined in your agreement, your debt will be settled. In addition, you may get out of debt faster, thus paying less interest and fees if you decide on financing with short repayment terms.

What Impact do Installment Loans Have on Your Credit?

Installment tools might help improve or hurt your credit, depending on how you manage your finances. Installment loans allow you to enhance your credit and demonstrate your borrowing power by making on-time payments since most lenders report to the three main credit agencies: TransUnion, Equifax, and Experian. Conversely, your credit score may decrease if you skip a payment or fail to return the loan. Setting up autopay is one approach to ensure your payments are sent on schedule. In addition, many lenders provide customers who utilize autopay a minor APR discount.

Installment vs. Payday Loans

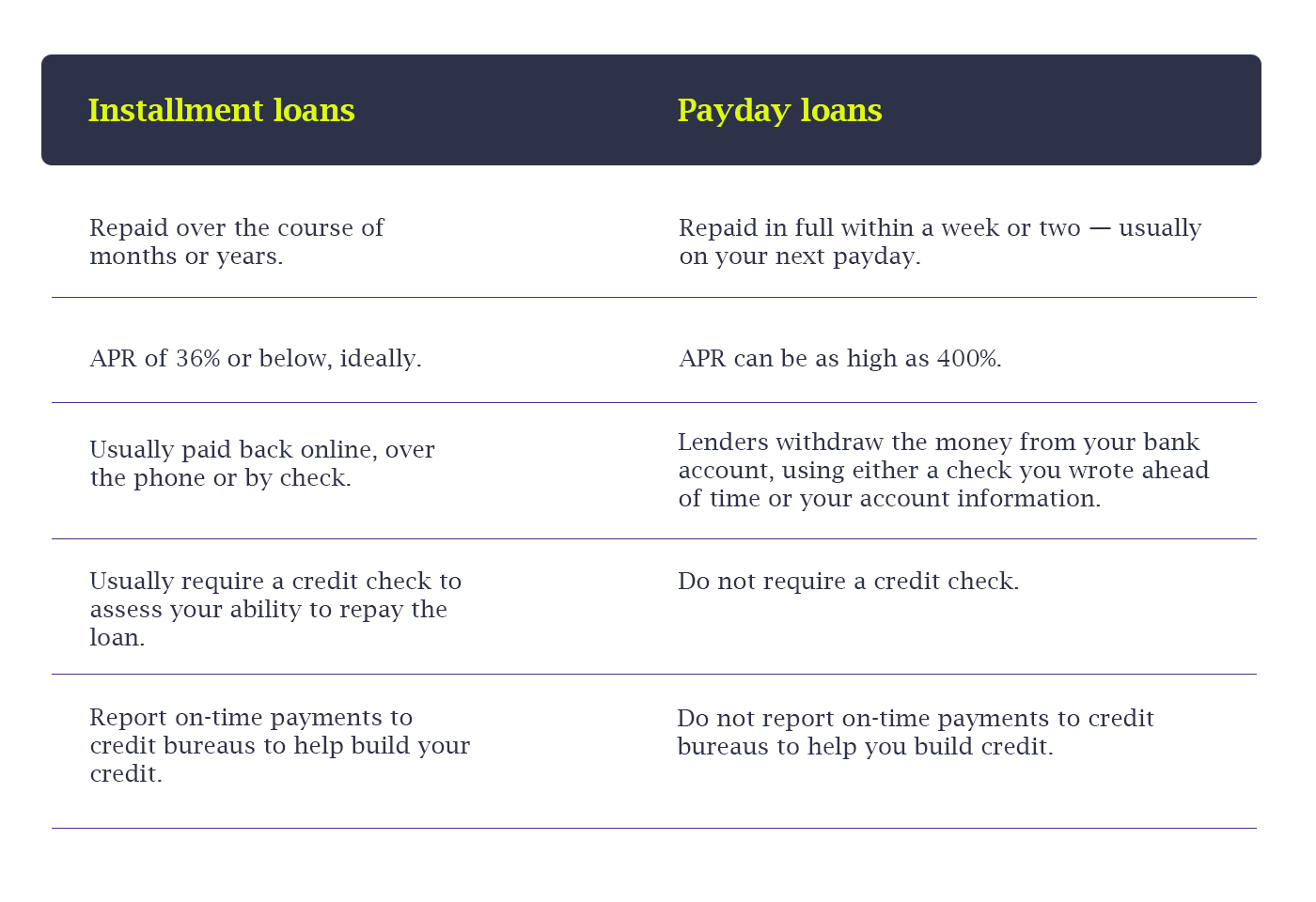

Installment loans are characterized by equated monthly installments (EMI). On the other hand, payday cash advances are not frequently repaid in installments. Therefore, installment financing is safer than payday advances since consumers can better manage modest payments over time rather than a single large payment. The following are some key distinctions between these two types of financing tools:

When to Consider Secured Installment Loans?

The main benefit of secured financing is that you may usually get more money since your debt is backed by collateral. On the other hand, the approval procedure for secured loan products might take longer since the collateral must be handled and validated. Because you'll benefit from cheaper interest rates, this first due research may be worth the extra effort. For example, secured tools can be used for large house improvements and debt consolidation.

When making more major modifications to your house, you may need to opt for a secured product, which is different from modest renovations. Secured financing provides you with a higher credit limit and a cheaper interest rate, which you might use for significant projects.

An installment loan might assist you in combining debts into one single monthly bill, plus qualify for cheaper APRs. In addition, these loans might support managing your debt payments because it has lower interest rates than payday advances or most credit cards.

Important to Know

However, you may lose your assets with secured loans if you default on paying on debt on time. Plus, you may hurt your credit score, let alone accounts under the collection that may stay on your credit report for more than seven years.